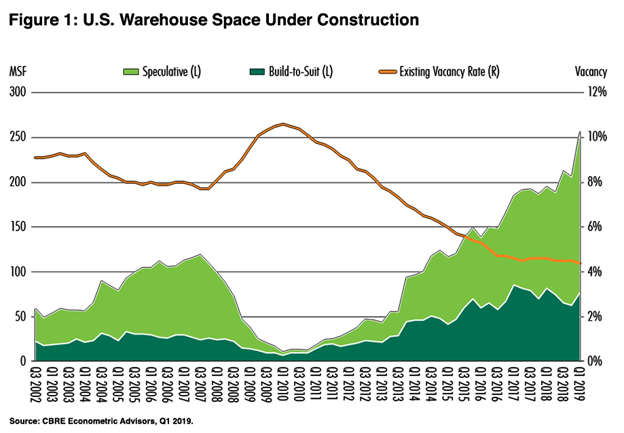

Some days this feels like the best of times for those who operate logistics companies and who operate industrial real estate, but the worst of times for those looking for a bargain on warehouse space. There has been significant economic growth, and the U.S. industrial market continues to expand. Nationwide, warehouse vacancy decreased to 4.3% in the first quarter of 2019. This is near the lowest this number has been since this data began to be tracked in 1980. In certain markets, it is even lower, sometimes just a few properties. Moreover, the Class A and B space was the first to be absorbed; much of what is currently available is Class C and D, and these are mostly 50-year obsolete properties and shuttered manufacturing plants. In response to this trend, new warehouse construction is going through the roof, with 258 million square feet in new space under construction, the majority of which are speculative buildings. However, this supply of new warehouses is still less than current demand.

Are you challenged to find high quality warehouse space and service providers where and when you need them? Spartan Logistics has been planning for this day for 30 years.

Warehouse rent is up 19% since 2015, and certain transactions inflate bidding rents even above asking prices for the best properties. As a result, this makes deals harder to close and landlords are demanding shorter term deals as well as higher escalator clauses. These market conditions have resulted in new construction, especially of spec buildings. Even with all this new industrial space under construction, builders are still struggling to keep up with the current demand. This new demand is mainly attributed to the growth of e-commerce companies needing warehouse space to fulfill customer deliveries. These factors have led vacancy rates to drop to record lows and warehouse value to increase across the board.

For 30 years, 3rd Party Logistics operators have followed the same basic playbook: solve a problem with our customer, then lease space in the correct place for a lease term that matches the service contract term. Industrial space has generally been a commodity- always available at the market price and generally homogeneous. The premiums were earned for excellence in service, technology, efficiency, and freight savings.

However, the new realities of the changing industrial market are putting pressure on the logistics sales process. Space itself is at a premium and can no longer be considered a commodity in most markets. We have lost multiple deals in the last year because we could not find space in the market acceptable to the customer that could be ready in the timeframe needed. We are headed to the point where the warehouse space itself will drive the transaction. This is transformative in several key ways:

- Operators who control their space, either through ownership or long-term lease, will not be at the mercy of real estate owners in terms of rate, lease term, or other matters. The visionaries who had the foresight and capital to gain control of space in the 2008-2011 time frame will be able to choose the customers they want to help and control the space they put these shippers in.

- Those who don’t control their own space will be reliant on others for solutions. This does not work out well. In one previous transaction, a customer had 2 weeks to find 70,000 -100,000 square feet for a large overflow project in a tertiary market. There were only 2 buildings available that met their needs, and one of those spaces did not even include offices or bathrooms. The first space went to a longer-term tenant, and the second space could not draft and execute a lease in the time frame needed. The customer eventually paid increased freight costs to ship the excess inventory to another market.

- The ability to move fast and close a deal will be critical- make sure your team is ready to go. If you are going to be in the market for space you need it is crucial to start with a really experienced real estate agent IN THAT MARKET and have your banker, insurance, lawyer, systems, and operations staff ready to move on an opportunity quickly. I can’t believe how many deals are readily available, but it will take 45-60 days to get phones and internet installed and working.

- Don’t expect a bargain. If space is available, be thankful. Be a good tenant and keep your promises. The landlord will have plenty of other options if you don’t.

- Make sure your warehouse contracts allow you to capture all these pricing increases along to the underlying customer/shipper.

Spartan Logistics, nearly from its inception, made the strategic decision to control the real estate we operate. Today, we own 85 percent of the nearly 3 million square feet of industrial space we operate, and our owners control another 2.5 million square feet of space we directly lease to other tenants.

In addition, we control our own construction company, real estate brokerage company, and property management company. This vertically integrated solution allows us to control class A industrial space where and when our customers need us, at prices and terms extremely competitive in today’s market.

Spartan Logistics- How can we help you?

Note: This post was originally published in June 2016 and has been updated for freshness, current trends, and comprehensiveness.