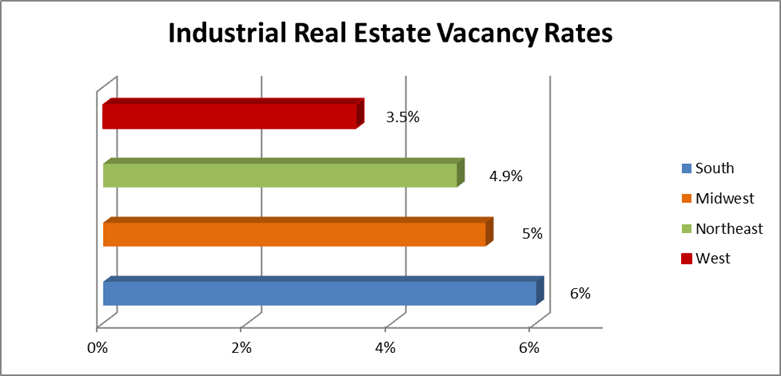

Are you in touch with what is happening in the industrial real estate market? A shortage exists everywhere, creating real challenges for businesses seeking to expand in their marketplace. For example, Napa Valley's industrial warehouse vacancies are now at 1.3 percent. The thriving wine industry finds its growth and margins constrained due to a lack of space to store inventory, and higher freight costs to store it farther away. In 2017, commercial properties in most markets enjoyed the sustained growth of demand, high occupancy rates, and rising rents. This is under added pressure in 2018 due to rising interest rates and increased U.S. manufacturing activity encouraged by recent tax reforms. U.S. industrial rents now average $5.53 per square foot with a year-over-year increase of 5.3 percent. Many tenants are in the difficult situation where expiring long-term leases are 30-50% below today’s market rates. For example, if you have been leasing space for the past ten years at a $4.50 sq. ft. rate and the owner comes to you this year to let you know the rate is increasing to $6.50 per sq. ft., your options are to absorb this cost, buy the building or vacate. Do you have an immediate plan in place to address the options you’ve been given? As top logistics markets continue to operate at a sub–3.5 percent vacancy rate, you can expect continued competition for quality warehouse and distribution space to add pressure on rents through 2018. First Quarter 2018 warehousing vacancy by US Region - Source: U.S. Real Estate News: U.S. warehouse and distribution rents rise as vacancy rates dip.

Read More

Topics:

Industrial Real Estate Market,

Supply Chain Strategy